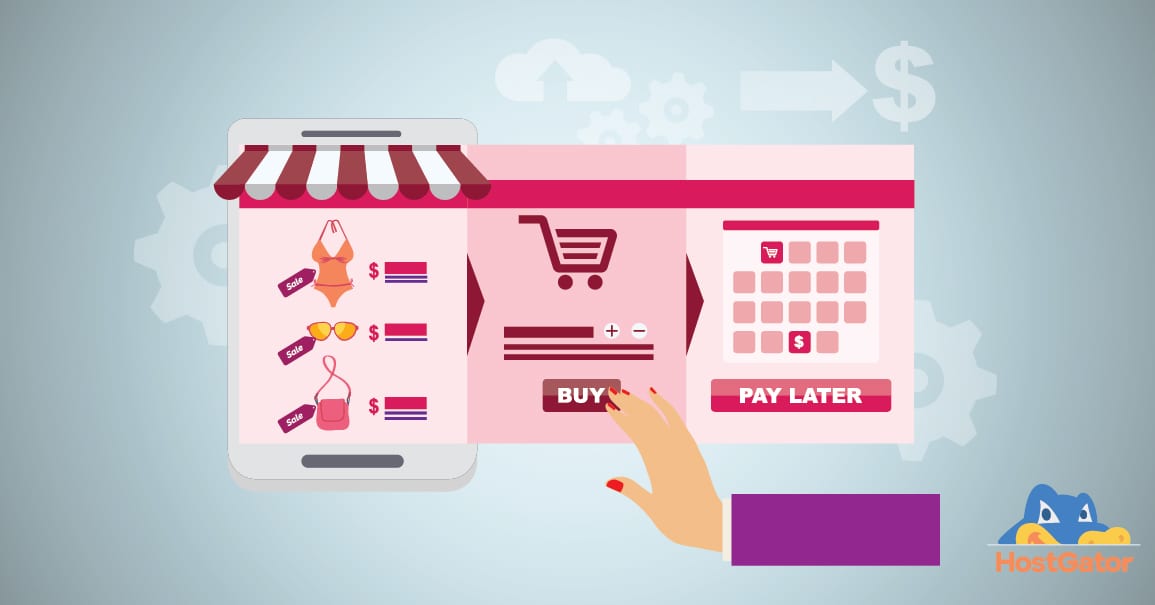

Does your online store offer Buy Now, Pay Later (BNPL) yet? If not, you may be missing out on sales. Yikes!

With Buy Now, Pay Later, customers order what they want, pay in installments (usually 4, every two weeks). Your store gets paid when the order is placed, minus fees from the BNPL service.

Customers get their items right away and don’t have to pay interest or fees as long as they make payments on time. It’s not surprising that a lot of shoppers love Buy Now, Pay Later.

Here’s what you need to know about why you might need Buy Now, Pay Later, how to choose a BNPL service, and how to set it up in your store.

We’ll look at a few of the most popular BNPL platforms so you can compare your options and decide what, if any, BNPL option is best for your store.

What does Buy Now, Pay Later offer your customers?

Buy Now, Pay Later helps you reach customers who don’t want to pay interest or add to their credit card debt. Younger consumers especially like BNPL, including 40% of the youngest group of millennials.

You can also reach customers who don’t have credit cards but have debit cards. And you can reach the customers with the most money to spend: 51% of BNPL shoppers earn more than $100K per year, according to PYMNTS magazine. That’s why designer brands like Theory, Jimmy Choo and Mansur Gavriel offer Buy Now, Pay Later.

Is there a downside for customers? Missed payments can lead to costly late fees.

What does Buy Now, Pay Later do for your business?

By letting a BNPL company handle installment payments for your store, you reduce your risk of payment fraud. Because you get paid upfront by the Buy Now, Pay Later provider, you don’t have to worry about a customer failing to make their remaining payments—that’s the BNPL vendor’s issue (although you should always read the terms to verify). And you don’t have to go to the trouble of setting up your own recurring payment plans.

You also get some marketing momentum when you partner with a Buy Now, Pay Later provider, because your store will appear in their shopping directory, so you can win new customers—including customers from other countries that are served by your BNPL provider.

You may also see an increase in revenue. Several studies (by BNPL providers) show that Buy Now, Pay Later customers make more purchases and spend more per order than customers who don’t use BNPL.

Is there a downside for retailers? Most Buy Now, Pay Later platforms charge higher transaction processing fees than credit and debit cards do.

Who offers Buy Now Pay Later for merchants?

The market for Buy Now, Pay Later is growing fast, with new companies getting into the space and even credit card companies trotting out their own pay-over-time options for their customers.

Here are four of the biggest BNPL players:

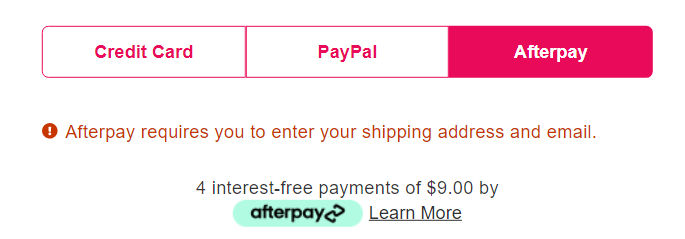

1. PayPal Pay in 4

Pay in 4 is included in PayPal Checkout, so you may already be offering a Buy Now, Pay Later option without having to do anything else.

Cost for merchants: 2.90% + 0.30 USD per transaction. The extension for WooCommerce is free.

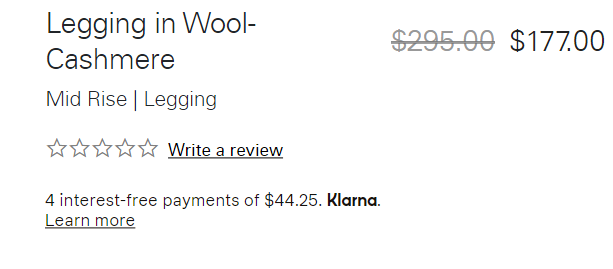

2. Klarna

Klarna integrates with most ecommerce sites and has an online shopping portal (Klarna Stores) and an app that lets shoppers use Klarna at any online store or in-store. Klarna users can earn rewards as they shop.

Cost for merchants: up to 5.99% + 0.30 USD per transaction. The Klarna Payments extension for WooCommerce is free.

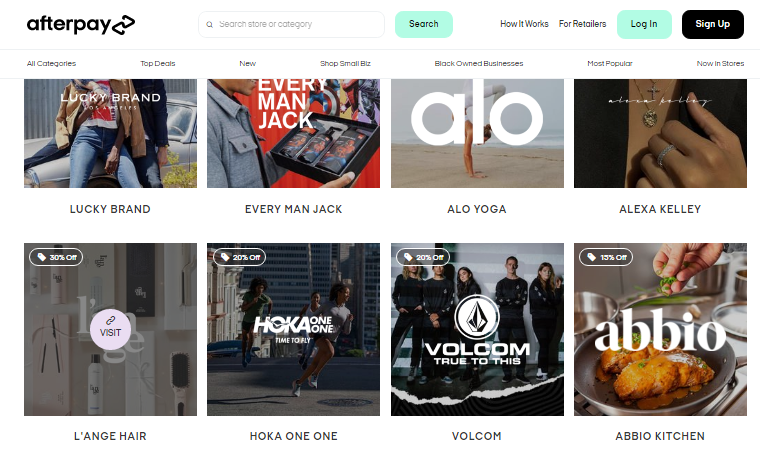

3. Afterpay

Afterpay, like Klarna and Affirm, integrates with eCommerce sites, has an online shopping portal and an app, and offers customers deals at their partner merchant’s stores.

Cost for merchants: Afterpay doesn’t list merchant fees on its website. Business Insider reports that transaction fees range from 3% to 6% of the order total. Afterpay’s WooCommerce plugin is free.

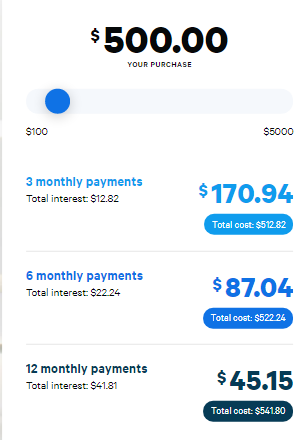

4. Affirm

Affirm offers many of the same features as Afterpay and Klarna—an app, a shopping portal, and special deals with partner merchants.

But Affirm lets shoppers spread payments over a longer time—up to 36 months for big-ticket orders, gives customers a choice of payment plans and charges interest on some plans.

Cost to merchants: Affirm doesn’t list fees on its site, but trade publication Merchant Maverick reports that transaction fees range from 2% to 3% of order totals. Affirm’s WooCommerce payment gateway extension costs $49/year.

How to set up Buy Now, Pay Later on your WooCommerce website

Once you’ve reviewed your options, compared the fees and made a decision, it’s time to set things up. First, as always, back up your site, just in case installation and setup don’t go as planned.

PayPal

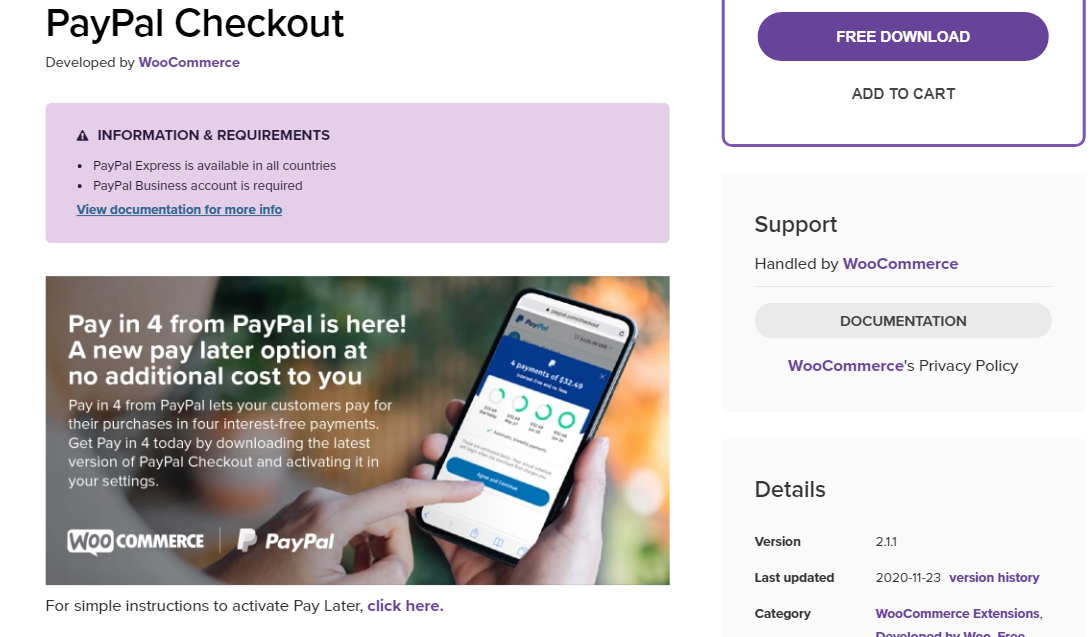

To add PayPal (which includes Pay in 4) to your WooCommerce store, visit the WooCommerce + PayPal page and click Get PayPal Checkout.

Then you’ll download the PayPal Checkout extension:

After it’s installed, you’ll need to go into your settings and activate Buy Now, Pay Later by adjusting your PayPal Credit (Pay Later) message settings.

Klarna

WooCommerce users will find two Klarna options in the Extensions Store, but only one works for merchants selling in the U.S. and Canada, and that’s Klarna Payments.

For Klarna to work properly, your WooCommerce settings must support pretty permalinks, anchor links and prices displayed to two decimal places.

Once installed and activated the Klarna plugin in WordPress, go to the WooCommerce tab on your dashboard. Select Settings, then Payments and then Enable Klarna Payments. You can then customize the description that will display in your checkout, choose to add a “What Is Klarna?” link to your checkout page, and make other customizations, including settings for each country you want to sell into.

Afterpay

First, download the Afterpay Gateway for WooCommerce plugin.

Then go to your WordPress admin dashboard to install and activate the plugin. Then go to the WooCommerce tab on your dashboard, open Settings, choose Checkout, select Afterpay and enter your credentials.

Affirm

Visit WooCommerce’s Affirm Payment Gateway page and buy the extension. You’ll get a ZIP file to upload to the Plugins section of your WordPress admin dashboard. After uploading, install the plugin and then activate it.

Next, you’ll need to configure the plugin to customize it for your site. Preview the setup and configuration steps here to see what you’ll need to do.

Whichever Buy Now, Pay Later platform you choose, test your integration before you go live.

Most Buy Now, Pay Later platforms offer marketing assets like site banners and templates for landing pages, email announcements and social media posts. (Here they are for PayPal, Afterpay, Klarna and Affirm.)

Grab the marketing assets for your Buy Now, Pay Later platform and use them to let your customers know about your new payment options. You’re all set to earn more with BNPL.

![How to Create Your Freelance Brand [5-Step Guide]](https://mdvirtue.com/wp-content/uploads/2022/02/How-to-Create-Your-Freelance-Brand-5-Step-Guide-400x250.jpeg)

![How to Build a Coaching Website on WordPress [Expert Guide]](https://mdvirtue.com/wp-content/uploads/2022/02/How-to-Build-a-Coaching-Website-on-WordPress-Expert-Guide-400x250.jpeg)

0 Comments