The holidays are almost here, and we’re more than halfway through getting your new online store ready to rock its first holiday sales season. Now that we’ve got marketing and shipping sorted, it’s time to follow the money—from your customers’ wallets to your business bank account.

Earning that revenue requires great products, smart marketing and super service. It also requires a less visible but equally important element that some new store owners overlook—ways to pay that your customers will actually use.

First, a brief discussion about friction (really)

You came here for holiday retailing tips and now we want to talk about physics? Not quite. As a new online store owner, it’s important to understand the concept of eCommerce friction, because it can make or break your customer experience.

This kind of friction goes by many names—payment friction, user friction, checkout friction. Anything that forces customers to take extra steps to spend money in your store is friction.

- Do your customers have to create an account to check out? Friction.

- Do they have to enter the same information twice for their billing and shipping addresses? More friction.

- Do they have to get up, find their credit card, and then key in the details? Even more friction.

- Do they have to use a payment method that they don’t recognize or don’t trust? Forget it.

The harder it is for your customers to pay you, the more likely they are to just leave. And they probably won’t come back, especially if your competitors offer them an easier experience.

Will your customers make it through checkout or just “check out?”

Year after year, the percentage of online shopping carts abandoned during checkout hovers around 70%. Cart abandonment is even more common among mobile shoppers, thanks in part to the added hassles of checking out on a tiny screen.

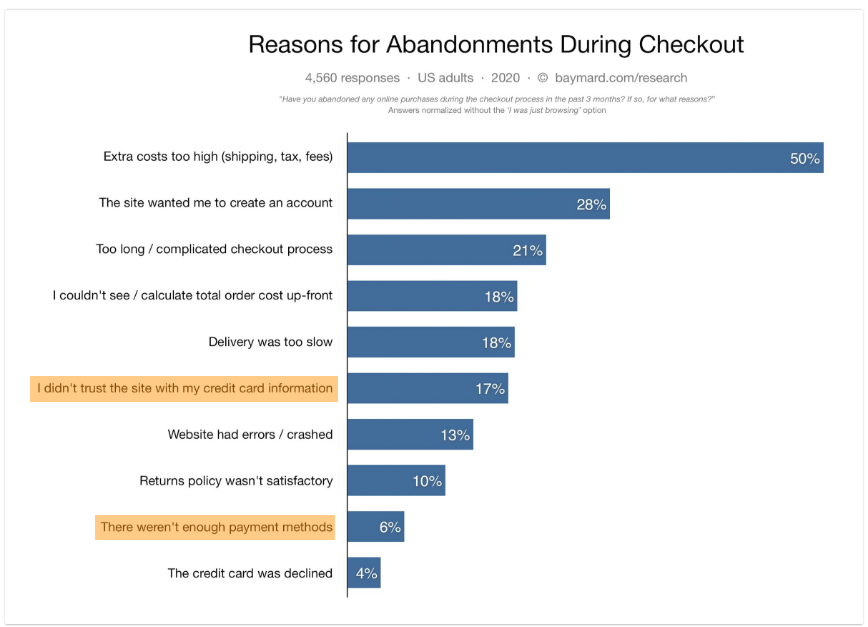

Here are the top reasons U.S. shoppers ditch their carts:

Almost all of these reasons are due to some kind of friction. Only 6% of shoppers abandon carts because there aren’t enough payment options, but 17% ditched sites because they didn’t trust them with their card data. That means those sites also didn’t offer enough payment options.

What do I mean by this? With a digital wallet like PayPal or Amazon Pay, customers can buy without sharing their card info with the merchant—and with buyer protections in place.

Fix the payment option problem and you can generate more revenue and create loyal customers. Ignore it, and you’re wasting marketing dollars to bring in customers who end up getting frustrated and abandoning their carts.

How easily can your customers get to “Pay Now”?

What about your online store? Ideally, you’ve built your checkout process to reduce cart abandonment at the earlier stages like login and promo code entry.

Now it’s time to see if your payment options are tripping up your customers. Your Google Analytics data can show you where customers are spending time on your site and where they leave. If the “pay now” page is where people are heading for the exit, then it needs improvement. If you only offer one or two payment options, consider adding more.

Digital wallets are easy, trusted payment options

As a general rule, you should offer at least one digital wallet option in addition to taking card payments. Some shoppers—most likely those sitting at a computer in the privacy of their own homes—will be comfortable whipping out a card and sharing the details with your site, if they trust it.

Everyone else, including people shopping on their phones, people who are somewhere public, and the sizable minority of online shoppers who don’t trust unfamiliar sites with their card data, will want a digital wallet option.

Convenience and trust are the reason 40% of US consumers pay with a digital wallet at least once a week, and the number of American shoppers with digital wallets is rising fast. As more shoppers get used to paying this way, they’ll expect the stores they visit to give them this option.

There are a lot of digital wallets you could add to your eCommerce store. Implementing them can take a few days to a week or more, so it’s good to get the process started well before the holiday rush.

Let’s look at a few of the best-known options.

Amazon Pay

- Anyone with an Amazon account can use this feature to check out. (For reference, Amazon Prime had 112 million U.S. members at the start of 2020, even before everyone started getting everything delivered.)

- Amazon Pay offers a 3-step setup process for small businesses.

- Amazon Pay works with virtually all operating systems.

Apple Pay

- Apple Pay had 441 million users in 2019.

- To add Apple Pay, you’ll need an eCommerce platform or payment service provider that supports it, unless you want to handle the coding yourself. WooCommerce is one of the platforms that supports Apple Pay.

- Apple Pay only works on iOS devices.

Google Pay

- Google Pay had 11 million users in 2018.

- Like Apple Pay, Google Pay requires you to add some code to your site or work with a platform/processor who can offer it for you. WooCommerce and Magento are two of the eCommerce solutions that work with Google Pay.

- Google Pay works on just about any device, including iOS devices.

PayPal

- There are 346 million active PayPal accounts, according to Statista.

- PayPal Checkout offers three different tiers of service, from simple copy-paste additions to your store to more complex integrations that require a developer’s expertise.

- PayPal works on virtually any device.

- PayPal supports Venmo integration—important if your store sells to the 40 million millennials and Gen Z shoppers who use the app.

Want more info? Explore more online payment options for eCommerce.

Which payment options make the most sense for your store?

All these digital wallets come with some level of customer authentication, fraud protection and purchase protection. They also come with processing fees (except Google Pay, which is free). In addition to comparing those fees, you’ll need to tailor your offerings to what your customers want.

So, have your customers asked for new payment options? Do they talk about using certain options on social media? Can you survey them? Going straight to the source is often best.

Another way to find out what works is to see what digital wallets your closest competitors accept and then add one or two of those options.

After you update your payment options, monitor your metrics for cart abandonment, order volume and average ticket value. If abandonment goes down and volume and value go up during this holiday season, you may have a winning slate of payment options. If you’re not happy with the results, make changes until you’ve got a low-friction checkout that your customers keep coming back, even after the holidays.

What’s the next step to get your store ready for its first holiday season? Setting up customer service options your customers will love. Stay tuned!

![How to Create Your Freelance Brand [5-Step Guide]](https://mdvirtue.com/wp-content/uploads/2022/02/How-to-Create-Your-Freelance-Brand-5-Step-Guide-400x250.jpeg)

![How to Build a Coaching Website on WordPress [Expert Guide]](https://mdvirtue.com/wp-content/uploads/2022/02/How-to-Build-a-Coaching-Website-on-WordPress-Expert-Guide-400x250.jpeg)

0 Comments